what is Assets and Liabilities.? A Simple Guide

What is Assets and Liabilities

Assets and Liabilities with Examples

Assets and Liabilities in Accounting

How Assets, Liabilities and Equity Are Linked

The connection between what is assets and liabilities and equity is explained through the accounting formula: Assets = Liabilities + Equity. This shows the balance between ownership and debt. It is the foundation of all financial records. If a company knows what is assets liabilities and equity, it can create accurate statements that reflect its true financial health.

Personal Assets and Liabilities

Understanding what is a personal assets and liabilities statement helps individuals track their financial standing. It includes all personal assets like savings and property and liabilities like loans or bills. This document is important for financial planning, applying for credit, or legal matters. It reflects how much someone owns versus how much they owe.

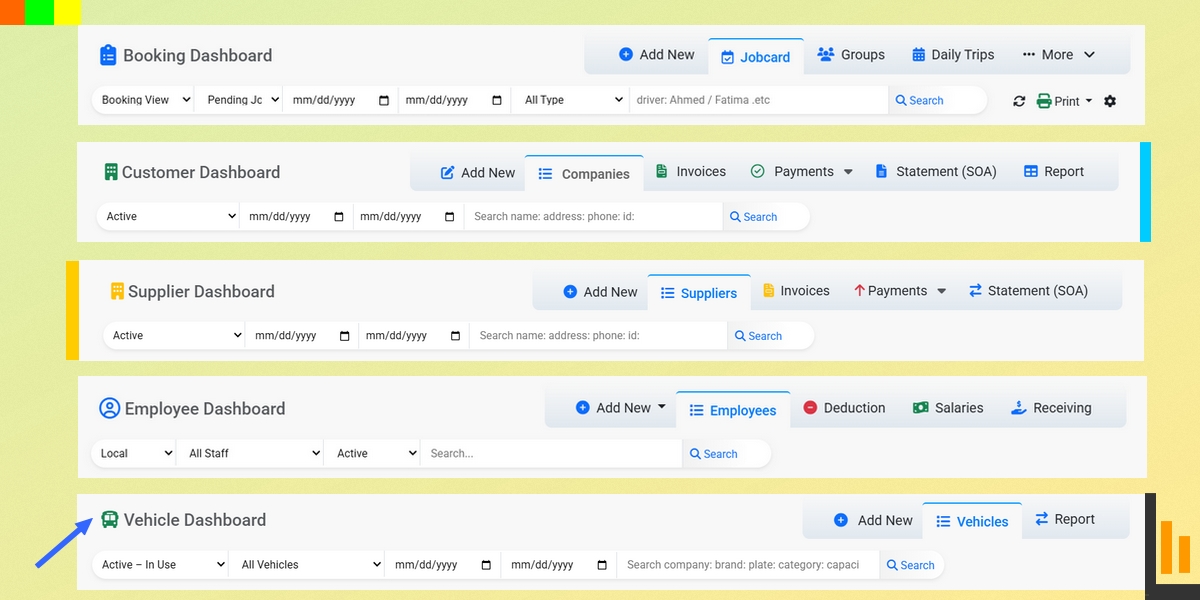

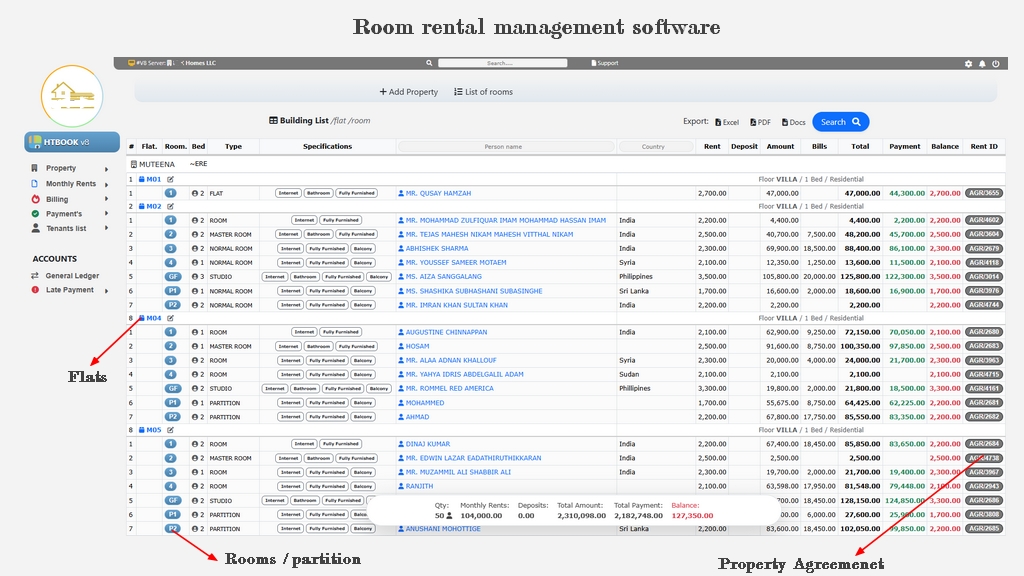

Assets and Liabilities in Business Operations

In the business world, knowing what is assets and liabilities in business means separating resources from obligations. Businesses track these using accounting software or financial systems. Assets include vehicles, buildings, and inventory. Liabilities may include unpaid salaries or business loans. This helps answer what is capital assets and liabilities and how they impact profit and operations.

Legal Affidavits and Financial Declarations

Sometimes, legal systems ask for what is an affidavit of assets and liabilities. It is a signed document that lists your financial situation. This is usually required in court cases, property division, or financial disputes. It is used to prove your capacity to pay or receive money. It applies to both personal and business matters.

Key Differences Between Assets and Liabilities

To explain what is difference between assets and liabilities, think of one as helpful and the other as a burden. Assets increase value, and liabilities reduce it. This helps in understanding what is assets liabilities and capital, which is the total value of a company after debts. People also compare what is assets divided by liabilities to check the strength of a company’s financial position.

Current vs Non Current Assets and Liabilities

Many ask what is the difference between current assets and current liabilities. Current assets like cash or stock can be used within one year. Current liabilities like rent or short-term loans must be paid in that time. Knowing this difference is important for maintaining cash flow. It also helps understand what is deferred assets and liabilities, which are future transactions already planned today.

The Role of Equity in the Accounting Equation

To realize what is the difference between assets liabilities and equity, it is necessary to know that equity is what remains after subtracting liabilities from assets. It reflects ownership. This helps answer what is the relationship between assets liabilities and equity, where all three work together to complete the financial equation. It keeps financial documents balanced and accurate.

Personal and Business View on Finances

People often wonder what is the difference between personal assets and personal liabilities. A personal asset could be a car or savings account. A liability might be credit card dues. When this is applied to a company, you look at what is assets liabilities common stock, showing how much ownership shareholders have. It is important for both small and large businesses.

Proper Classification of Financial Items

Many search what is considered liabilities and assets to properly group their finances. For example, office furniture is an asset. A business lease is a liability. Categorizing things correctly leads to a clear financial picture. This includes understanding what does assets and liabilities mean in reports. It shows whether your business or personal finances are stable or need attention.