What is Income and Expense.?

Understanding Income and Expenses

Income applies to the money you earn, while expenses are the money you spend on items. These two phrases are the basics of personal and business finance. Knowing where your money comes from and where it goes is essential for building a healthy financial future. arranging income and expenses well helps avoid debt, ensures savings and enables long term financial targets.

What is Income:

-

Sources of Income: This is where your money comes from. It could be a job, allowance, gifts, or even money earned from selling something. Any way you make money adds to your income.

Regular vs. Irregular Income: Regular income is like a monthly salary – it comes in predictably. Irregular income, on the other hand, might be money from odd jobs or occasional bonuses.

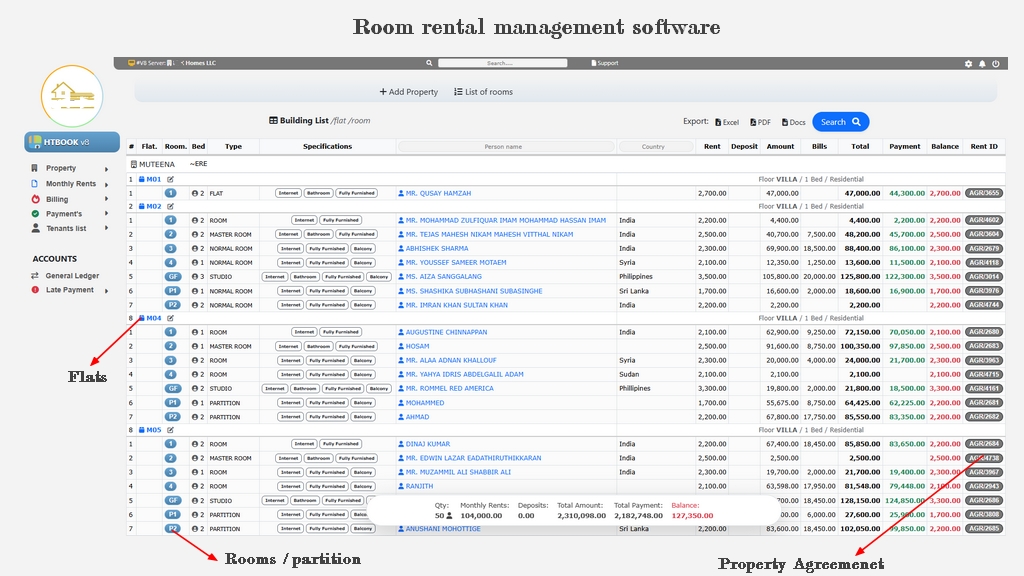

Passive Income: Some people have income that doesn't require constant effort, like rent from properties or earnings from investments.

What is Expenses:

Fixed vs. Variable Expenses: Fixed expenses are the regular bills you have to pay, like rent or mortgage. Variable expenses change, like groceries or entertainment – you have more control over them.

Necessities vs. Luxuries: Necessities are things you really need, like food and housing. Luxuries are things you want but can live without, like a fancy gadget or an expensive dinner.

Saving and Investing: Setting aside money for future use or investing in things like stocks or bonds can be considered a positive type of expense because it's using money to potentially make more money.

Balance:

Budgeting: This is like creating a plan for your money. You decide how much goes to different things – like how much for rent, groceries, or saving. It helps you avoid overspending.

Emergency Fund: Having a little money set aside for unexpected expenses (like a sudden repair or medical bill) can be a lifesaver.

Financial Goals: Saving for specific things like a vacation, a new phone, or education is a great way to manage your money. It gives your spending a purpose.

In essence, understanding your income and expenses isn't just about numbers; it's about making choices that help you live the life you want. Balancing them wisely is the key to financial peace of mind.